We re Going to Make Accounts Payable Exciting Again

When I want people to think I have a boring job, I ordinarily tell them I work with accounts payable. This is constructive when I'm at a party and desire to exit, or any other time I'1000 engaging in pocket-sized talk. In reality, I think accounts payable work is exciting.

Processing accounts payable is a great way to become a experience for a business. You lot meet what expenses are going through and how oftentimes.

- Is one section constantly ordering more raw materials while some other section is wasting more and more on overhead?

- Is a project manager processing invoices for a job months after the job was supposed to exist closed out?

- Which vendors permit you lot to stretch out paying equally long equally possible?

If yous're not lucky enough to be able to process day-to-24-hour interval invoices in your business, the accounts payable aging report is the best mode to become an overview of what's going on.

Overview: What is an accounts payable aging report?

Accounts payable (AP) is the corporeality you owe your vendors. When yous purchase inventory or supplies or hire subcontractors, the vendor will send you an invoice showing what you owe, and this is booked as an account payable. When you pay the invoice, that amount in accounts payable goes away.

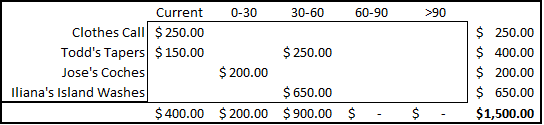

The accounts payable aging report shows all current unpaid invoices. Balances are typically dated in 30-day increments. So yous will bear witness each vendor with its current residual owed separated out to the amount that is current, 30 days past due, 60 days by due, and 90 days by due. The aged payables residuum should foot to the accounts payable balance on the general ledger.

How to manage accounts payable aging reports

Here are the best tips and tricks for the accounts payable process.

ane. Determine setup

The starting time footstep is to fix the AP report in your accounting software. You should fix up the report to mimic how you lot budget. If you have split up unrelated departments, make sure they get their own reports. If yous run a construction company, create a dissever written report for each job or a written report that shows APs by job, not past vendor.

You can also use specific accounts payable software for your AP accounting. This will brand it easier to manage vendors and send them 1099s at the terminate of the twelvemonth.

2. Use purchase orders

Once your business organization reaches a certain size, it is important to have department or projection managers consummate purchase orders for new purchases. Each manager should have a dollar corporeality up to which they tin can personally approve and all purchases should be approved by a manager.

A mutual way to do this is to have the manager complete a form outlining what is to exist purchased, and for what department/job, and then transport it to accounting. When the invoice comes in, the invoice will be tied to the purchase social club.

The bigger your visitor gets the more important it is to have effective internal controls. Information technology'due south surprisingly easy for conniving employees to embezzle money with imitation or adapted invoices and the all-time mode to wearisome this down is to necktie every invoice to an individual.

The same is true for credit card purchases. If yous're going to trust an employee enough to give them your credit bill of fare number, y'all may every bit well give them a company credit card so that you can runway purchases back to an private.

3. Enter invoices when received

In accrual accounting, you volume expenses when they are incurred, not when they are paid. This means if you lot haven't paid for subcontractor work on a job, but you have received the invoice, it needs to be accounted for. Enter the invoices with the invoice date and they will show up on the trial residual every bit of that date.

4. Determine when you will pay

A lot of businesses will manage their working capital to increase operating cash menstruum. The longer you can put off paying APs while nonetheless quickly collecting accounts receivable the ameliorate your greenbacks flow volition be. Yous are financing sales interest-free with accounts payable.

Dell pioneered this strategy in the '90s with its merely-in-fourth dimension inventory strategy. Dell would charge customers for their lodge and then order parts for the figurer. They'd immediately exist paid on the chore simply sometimes not have to pay their vendors for sixty or 90 days. This working capital tin can exist used to expand the business.

Don't just start using this strategy out of the blue. Y'all'll finish up with a ton of aroused vendors and service charges. The cardinal is to work on the relationship with vendors over time and build leverage. You tin can and then start to negotiate longer pay times.

Additionally, if you're running a structure company, information technology is a good idea to pay but when paid. If you lot tin can make information technology piece of work, put a clause in your subcontractor contracts maxim the sub won't be paid until you are. This doesn't work equally well with materials purchases, so, over again, build relationships with your suppliers that let you lot to push button out pay times.

5. Reconcile with other accounts

The final step is to reconcile your reports. Make sure the AP crumbling report rest matches what is on the rest sheet. Your bank will certainly be doing this, specially if y'all have a line of credit.

Y'all should too make certain your AR report reconciles with the balance sheet. If you accept a line of credit, your bank volition be checking the payables and aged receivables and using that as collateral each calendar month.

six. Call back about timing issues

You'll often receive invoices that are dated far before yous receive them. The original could've been lost in the mail or the managing director in charge of blessing it could've lost it.

This isn't a real-life problem if your vendor is patient and allows you to pay tardily. The fake-life (aka accounting) problem is with AP timing.

I spend the first week or so of each month doing financials. My fiscal cycle is a footling longer than well-nigh considering I work at a construction company and have to do a ton of fun stuff with works in progress. So by the time I finish, I have inevitably processed 2 or iii batches of checks and invoices.

Here'due south where the trouble comes in. If I processed a check on October 4 (before I was finished with September financials) that had an invoice date of July 12 (because the invoice got lost originally or something) my AP crumbling for September 30 is going to show a by due balance for that invoice considering it was paid after September 30 but dated before.

You lot can fiddle around with dates in your software to make this not happen. Or, yous tin do what I do, which is merely ignore it. Just exist prepared with an explanation if the bank or an auditor comes asking why you lot have past due balances.

Example of an accounts payable aging study

Let'southward accept a expect at a sample AP aging:

The full AP balance is $1,500.

The full AP balance is $1,500. Amongst the vendors shown, Wearing apparel Telephone call is fine, as its only invoice is still current. Todd's Tapers has a $250 invoice that shows 30-threescore days past due. In fact, only $400 of the total remainder shows electric current.

This may not be a problem. It depends on what the strategy is and when the invoices were received. The real problem is when the APs get into the >90 column. It is very rare to take a vendor relationship where paying more than 90 days late is acceptable.

Pass your AP (aging) exam

I won't fault you if yous nevertheless don't recall accounts payable are exciting; information technology takes a special, strange kind of person to feel that. But I promise you now empathize how important it is to effectively rail your AP and manage it efficiently.

The Motley Fool has a Disclosure Policy. The Author and/or The Motley Fool may have an interest in companies mentioned.

pattersonsocconeregal.blogspot.com

Source: https://www.fool.com/the-blueprint/accounts-payable-aging-report/

0 Response to "We re Going to Make Accounts Payable Exciting Again"

Post a Comment